FIN - General Accounting

The CANIAS ERP financial accounting is completely embedded

into the concept of an integrated enterprise software which

can also be operated by itself without any other system components.

However, to obtain the highest rate of capacity utilization,

the operator should use the module in conjunction with the

IAS-components purchase, sales, inventory management and production

planning and control.

Goals

The philosophy of the CANIAS ERP Software and its integrated

financial accounting is to take aim at the reduction of the

time-consuming recording of every single process. However,

the complete information of all documents produced anywhere

in the company will be transferred into the financial accounting

module.

Integration into the entire conception

Financial Accounting can be considered as the center of the

document system of a company. Data of all money related transactions

are consolidated here. Documents from the following modules

are used for further processing:

Due to this data flow the entire company-related procedures,

from purchase order to incoming invoice or from order receipt

to goods issue (outgoing invoice) are reproduced. The financial

accounting verifies, by means of this data, the correctness

of invoice receipts and controls the outgoing payment or monitors

regular payment receipts.

Control and Checktables

The CANIAS ERP Financial Accounting module is supported by

various control and check tables. Therefore, users have the

possibility to adjust certain functions to their specific

needs, without any program changes. Several entry fields within

the CANIAS ERP Financial Accounting are designed with the

so-called, check and zoom function. This means that entered

values in such fields are suggest and compared with entries

in check tables. When there are any inconsistencies a rejection

notification will be displayed.

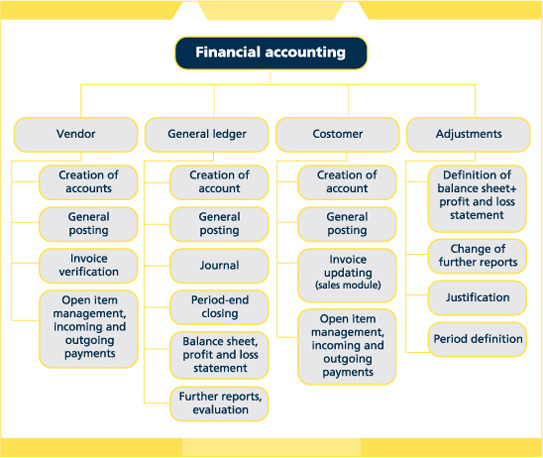

Structure of Financial Accounting

Accounts

Apart from managing general ledger accounts, also sub-ledger

accounts are managed, especially vendor and customer accounts.

Accounts can be kept in any currency.

Documents

In the financial documents all relevant data like account

number, posting date etc. are stored. Editonally purely information

fields like posting text, material type, customer name and

so on can be saved.

Invoice Verification

The invoice verification is the point of intersection between

purchase and accounts payable. Data comes from the CANIAS

ERP Modules purchase and inventory management. The accountant

is able to look at all important data to order items in a

list-box. When a received invoice is ok, a simple mouse click

on the order item is enough, to

- update data records for order items,

- generate postings on general ledger accounts (payables, delivery costs, input VAT and

- goods issue/goods receipt),

- generate a posting on an account corresponding to the vendor.

This posting is treated as so-called Open Item. It controls

the outgoing payments (in accordance with the maintained cash

discount data of the vendor master record).

Open Item Management

The open item management supports in the accounts receivable

and accounts payable the posting of payment receipts and the

outgoing payments.

Both with invoice verification and when posting outgoing invoices,

documents will be posted as open items. While posting those

figures can be displayed. He can choose among different selection

criteria (for example he can search for vendors/customers).

Again, a simple mouse click is enough and the open invoice

will be posted as paid or ordered for payment. Obviously,

an accountant is also able to post to each open item partial

payments, as well as to change payment conditions.

Payment receipt monitored verifies from an anccounts receivable

point of you, if all payments due are received. If this is

not the case, the system induces the dunning process.

Fiscal Year and Fiscal Period

Number and duration of the booking periods are freely adjustable

by the user.

Balance Sheet and Profit and Loss Statement

The user is able to create its own balance sheet and profit

and loss statement according to his needs in numerous versions

and at any time.

Journal

The accountant is able to look at or to print out a journal

at any time.

Justifications

A justification is allocated to each menu point in order to

ensure that only certain employees can prepare balance sheets

or PLAs, and that only the authorized accountant can assign

payments.

Print Functions

Balance sheet, profit and loss account, journal and account

sheets, as well as other evaluations, can be printed directly

from the application.

|