|

PRC - Production Costing

Calculate the real costs of your products on time thanks to CANIAS ERP Cost Centers Accounting and Real (Activity Based) Costing Modules.

Significance that we attach and money that we spend for certain concepts such as R&D, technology investments, training, quality, branding and marketing in today's corporation increase day by day. Even more it became a matter of existence - distinction to make a development under these tough competition circumstances.

As a direct result of this situation, management costs quietly increased amongst those elements that create our product costs. Consequently, it almost became

impossible to find the real cost of a product through traditional costing methods.

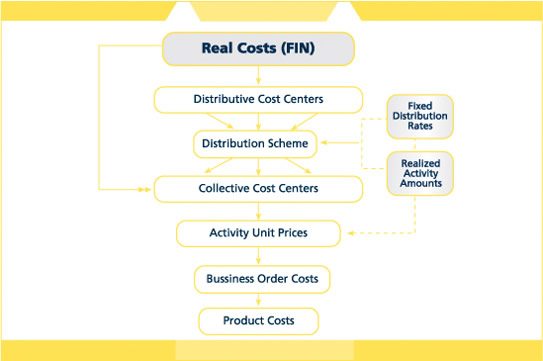

Here, to solve this robust problem we developed CANIAS ERP Cost Centers Accounting and Real (Activity-Based) Costing modules. Depending on activity-based costing bases this

module focuses on activities within your product processes and allows you to see which activities produce value and which not on a technical dimension.

Real (Activity Based) Costing module finds the real costs of your products and lets you develop measures and strategies that decrease costs and increase profitability.

In addition, thanks to CANIAS ERP infrastructure that has been developed basing on the rational to enter data easily and quickly once and to use it within the entire system,

it is cost efficient to calculate real cost.

| |

|

- Follow-up of all types of costs in cost centers basis

- Defining Distributive/collaborative cost centers

- Designing free distribution scheme between cost centers

- Distribution of costs between cost centers in percent

- Distribution of costs between cost centers basing on activity amount

- Distribution of costs between cost centers basing on direct costs

- Controlling costs remaining after distribution

- Calculating unit activity costs planned

- Individual follow-up of fixed/variable costs in every step of calculation

- Individual follow-up of direct/indirect costs in every step of calculation

- Costing on phase basis

- Costing business orders in activity basis

- Costing business orders continuing at the end of period

- Fragmenting product in disassembly business orders and creating semi-finished costs

- Achieving shares from business order costs by valuable by-products

- Costing outsourced productions

- Cost follow-up in project basis

- Cost follow-up in customer order basis

- Cost follow-up in customer basis

- Possibility of different costing in facility basis

- Calculating unit activity costs budgeted

- Detailed track of costs distributed between cost centers

- Detailed reporting of components creating product costs

- Reporting costs remaining on cost centers after distribution

- Using unit activity costs calculated in standard costing

- Easily recording production costs to the accounting

- Calculating activity unit costs on budget

|

|

|

|